Ethereum network helped to increase the versatility of blockchain technology. Though Ethereum is not the first blockchain network, but it has the highest use cases. DeFi (Decentralized Finance) became a reality through the Ethereum blockchain network. Ethereum has also brought about a lot of improvement in blockchain technology and still has more to offer in the future. In this article, you will learn all about Ethereum, unique features of Ethereum network, PoW vs PoS, challenges faced by Ethereum, the future of Ethereum, why Ethereum is seen as the “future of blockchain”, etc.

All About Ethereum

Ethereum is a decentralized blockchain network designed to perform many tasks (unlike Bitcoin network that was designed to perform only one task). The blockchain network can be seen as a “smartphone” or a “software platform” where blockchain developers can use to build smart contracts and new blockchain applications, usually called Decentralized Applications (DApps). These applications can be as simple or complex as any app you can think off, such as P2P marketplaces, micro-payments platforms, online gambling apps, etc. Ethereum blockchain network is powered by its native cryptocurrency, called Ether (ETH). Developers who and all other blockchain users who use Ethereum network pay a fee for using the network in Ether (ETH). This fee is usually known as “gas fee”. Ether is the second largest cryptocurrency by market capitalization (M.Cap.).

Just like BTC, ETH can be also serve as a store of value and as an investment opportunity, where investors buy at a certain price range, hold it with the hope that the value will increase with time, and then sell for profit.

Ethereum network has an open source nature, which makes it possible to also power other cryptocurrencies. Ethereum is already powering tons of other cryptocurrencies like Chainlink (LINK), Uniswap (UNI), Tether (USDT), etc. More crypto projects will be built on Ethereum network in future.

Ethereum’s Root and Main Development Teams

Ethereum’s first whitepaper was published in 2013 by the company’s CEO, Vitalik Buterin, a Russian programmer. The network has many contributors and team of developers. But there are five founding members, which include:

- Vitalik Buterin

- Anthony Di Iorio (CEO, Decentral)

- Charles Hoskinson (CEO, Cardano)

- Mihai Alisie (CEO, Akasha World)

- Amir Chetrit

In 2014, a crowdfund campaign was conducted in which ETH was sold to investors and more than 18 million USD was raised. And on 30th July, 2015, the capital raised via crowdfunding was used to launch the Ethereum network, with an initial supply of 72 million Ether (ETH).

How Ethereum is different from Bitcoin and Other Blockchain Networks

Decentralized and Open-source Nature of its Blockchain

Instead of using centralized servers, nodes are used in ethereum’s network. These nodes are run by volunteers all over the world. By being a decentralized network, all the nodes in ethereum’s network hold identical copy of the ledger which includes past transactions. But the ecosystem is not controlled or managed by any central node or party.

Versatility of the Native Token

The native digital token (ether) does not just serve as a store of value, as in the case of Bitcoin. It can also be used for investment, payment method (to settle smart contracts and for transaction or gas fee payment).

Broad Use Case

Ethereum is known as a second generation blockchain because apart from its smart contract functionality, its distributed ledger network also allows developers to build new applications (DApps) and non-fungible tokens (NFTs), thereby broadening the use case of Ethereum network.

A smart contract is a program on the Ethereum network that is capable of running autonomously and helps to power DApps built on Ethereum network. Smart contracts automatically perform a specific function when certain criteria are met.

More use cases for Ethereum network will emerge in future.

Check:

The need for the London Hard Fork and Its Impact on Ethereum Network

On 5th August 2021, a major upgrade which was stated on Ethereum’s roadmap, the London hard fork was activated. The “Ethereum Improvement Proposal” (EIP 1559) was a major part of this upgrade. The EIP 1559 main aim is to apply a transaction pricing mechanism, which includes a network fee (fixed per block) that will be burned, in order to dynamically expand/contract block sizes, mainly to solve the problem of network congestion.

Before the London hard fork, Ethereum users usually pay gas fee before any transaction will be processed on the network. Since miners benefit mainly from the gas fee and in order to maximize their earnings, they give top priority to transactions with higher gas fee bids, this leads to increased network congestion. So this means that as a user, if you want your transaction to be processed faster you need increase the gas fee. All these manipulations reduce the transaction speed of Ethereum network and also cause volatility in gas price. So to solve this gas price volatility and network congestion issue, the EIP 1559 introduced a new price auction model where the gas fee will be replaced by a fixed-per-block network fee, which will be automatically calculated, with slight fluctuations, to reduce network congestion drastically. This price auction model is not aimed at making Ethereum gas fee very cheap, rather it aims at reducing the high fluctuation in gas fee paid by users, although there will still be an option for users who want their transactions processed faster to tip the miners.

Another major change under EIP 1559 is that Ethereum network will automatically burn part of every transaction fee and remove them from circulation. Most investors speculate that this will help address one of the criticisms of Ethereum, which is unlimited supply and thereby make ETH a deflationary token. Other investors opposed that in short term, the EIP 1559 alone cannot make ETH a deflationary token because the nominal amount of the gas fee burnt will not outpace the network’s rate of inflation (that is the rate of issuance of new ETH). But these second group of investors admitted that the EIP 1559 upgrade has improved Ethereum users’ experience and might also boost the price of ETH on the long run, especially after a smooth transition to Ethereum 2.0.

Also, the gas fee burning process will reduce the rewards Ethereum miners get.

One of the EIPs included in the London fork is EIP 3554, which is meant to encourage Ethereum miners and node operators to upgrade their software at a predetermined interval. Although it didn’t get much attention as EIP 1559, but the effect will also pave the way for the most anticipated Ethereum 2.0 upgrade.

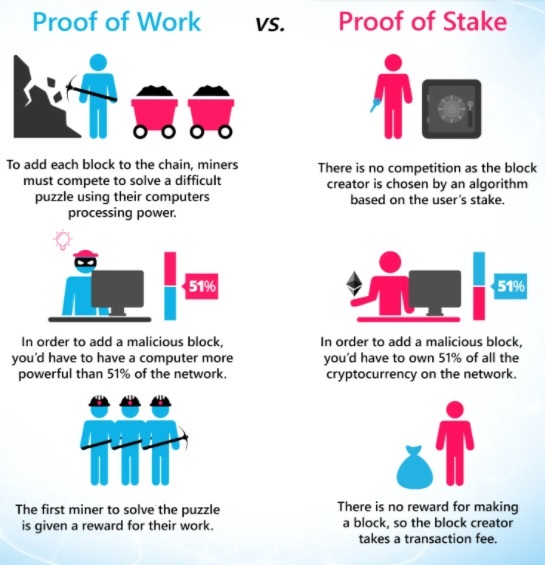

PoW vs PoS

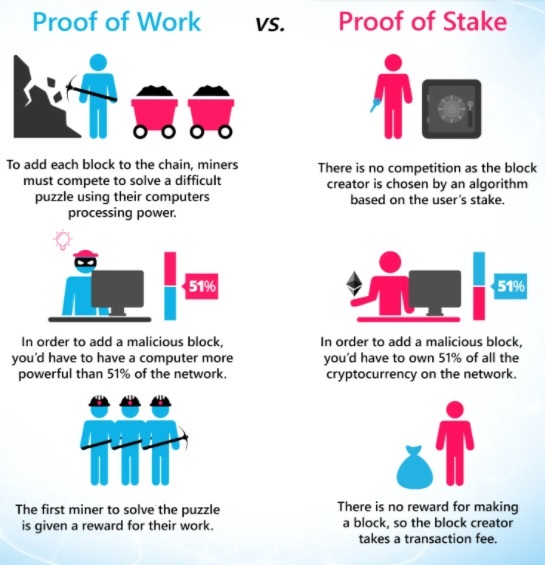

PoW stands for Proof of Work, while PoS stands for Proof of Stake. They are the two main types of consensus blockchain models we have. Bitcoin uses PoW model. Ethereum still uses the PoW model, but will switch over to PoS model after a successful transition to Ethereum 2.0. In order to understand fully how Ethereum 2.0 will help to transform the Ethereum network and the entire blockchain industry, you need to understand how both PoW and PoS work.

The PoS model has many advantages over PoW, which includes: Scalability, Energy Efficiency, Economic security, etc.

The image below shows how both PoW and PoS work and their differences.

The Main Challenges to be solved by Ethereum 2.0

Below are some of the core challenges to be solved by Ethereum 2.0.

Network Congestion

EIP 1559 has already addressed this to an extent. Network congestion problem on Ethereum network will completely be solved after a successful transition to Ethereum 2.0.

Scalability

PoS will help solve Ethereum’s scalability issue by enabling sharding. Sharding in terms of a database is the process of performing a horizontal partitions (each partition is called “shards”) on the data stored on a bulky database, and then storing the partitioned data on different database servers. Sharding makes the processing of information faster by splitting a state into shards. When sharding is implemented on a PoW model, the smaller shards might be hijacked by a malicious miners because of its low hashrate. The risk is mitigated in PoS because it does not have the concept of mining.

Energy Consumption

PoW model consumes more energy than PoS model. Bitcoin mining alone consumes an average of 28.48 TWh worth of electricity, which is more than what some countries like Ireland, Slovak Republic, Bahrain and Ecuador consumes. This is because of the sophisticated equipment needed for mining. The average annual global mining costs for Bitcoin is $1,423,794,674.

The PoS model is more energy efficient (up to 99.95% than PoW) because it does not use the concept of mining. So once Ethereum switches fully to PoS, the problem of excessive energy consumption will be solved permanently. This will make Ethereum network more environmentally sustainable for mass adoption.

Ethereum is planning to solve most of its current challenges with the aid of the Casper Protocol. You can learn more about How Ethereum Casper Protocol will transform Ethereum Network.

Ether (ETH) Live Price Chart

Below is Ether’s live chart showing the latest price of ETH, with its 24 hour highest and lowest price.

Can Ethereum Beat Bitcoin in Terms of Market Capitalization in Future?

This question has been asked by many investors. Bitcoin only has one main function, which is a store of value, and maybe the added advantage of being the first blockchain network. But in reality, Ethereum has more use cases than Bitcoin. Apart from serving as a store of value, Ethereum has created a truly decentralized network, with smart contract functionality that powers DApps and other powerful projects, including NFTs. Despite the current challenges faced by Ethereum, it is still among the world’s most technically advanced blockchain networks, with team of developers working actively to improve the platform.

Currently, Ethereum is the second cryptocurrency by market capitalization, after Bitcoin. Few years from now, Ethereum might become the backbone of crypto-asset ecosystem, overtaking Bitcoin as a dominant store of value. Most smart investors are already hodling more Ether (ETH) because of its multiple, powerful use cases and its hidden potentials. Most investors predict that once the transition to Ethereum 2.0 becomes successful, most of its current challenges (especially the scalability and energy efficiency issues) will be solved, then Ethereum will definitely snatch the “number one” title from Bitcoin, as Ether is a digital currency with better tech agility, and is already becoming popular among top cryptocurrency investors. You can read more about Ethereum network and its future in this article.

See:

- Cryptocurrency Staking (PoS) Guide for Beginners

- How to Spot Crypto Projects with Powerful Potentials

Conclusion

Ethereum is the power house of DeFi and still has more to offer in future, especially with its smart contract feature which makes it possible for individuals who do not know each other or even trust each other to carry out transactions without any third party or intermediary. With Ethereum 2.0 projected to solve most of the current challenges of Ethereum, it might beat Bitcoin and become the number one blockchain network.