One of the key secrets of making huge profit in crypto trading is spotting and investing in crypto projects which have powerful potentials. When you discover these projects and invest in them at the early stage, you make huge gain when the project becomes very popular and successful. You make much profit because you invested in them when they are very cheap, so the huge profit is the reward for investing early. There are up to 3000 crypto projects out there, so most times, it is not very easy to tell the ones that will succeed. But there are tips that can help you evaluate and discover these cryptocurrency gems and how to invest in them early in order to make much money from them. All these are revealed in this article.

Things to Check when Searching for Cryptocurrency Gems

1. Relevance of the Use Cases of the Crypto Projects

Before you invest in any project, you need to know the problems the project can solve, that is its use case. Then you also ask yourself these questions:

- How relevant will this project’s use case be in future?

- Can it solve any of the core challenges in the blockchain space?

- Are there competitors who can solve the same problem, and what approach will these competitors apply while trying to solve that same challenge?

- Which unique features differentiates the project from other similar projects?

These questions will help you predict to an extent, the future potential of the project.

2. The Maximum/Total Supply of the Cryptocurrency

Some crypto project tokens have a stated maximum number of the token that will ever be available stated under the tokenomics section of the project’s whitepaper. For example, the maximum or total supply of Bitcoin is 21 million, while that of Ethereum is not known. Also note that maximum/total supply of a coin or token is different from its current/available supply.

It is believed that coins with small total supply or specified total supply will do well in future. This is because when the project becomes popular, it will attract more investors. Since the total supply is fixed and demand is increasing, definitely the price of the coin will skyrocket. But this is not always true. Some Crypto projects like Ethereum (ETH) whose total supply is unknown, is one of the exceptions to this belief or idea.

For projects that have DeFi use case, instead of being more concerned about the total supply of a coin, check the percentage of the coin that is currently available and the TVL (Total Value Locked) of the token. It represents the fiat value of the number of the coin or token that is currently being staked in a specific protocol. Most times, the TVL ratio of some DeFi projects helps us to know if the project is undervalued or overvalued at the moment.

TVL ratio is calculated by dividing the market capitalization (M.Cap.) of the coin by its TVL. In most cases, if the ratio is less than one, then the project is undervalued. But if it is greater than one, then it implies that the project is overvalued.

See:

3. Does the Project have a Reputable and Transparent Team and CEO?

Ensure that the development team and CEO of the crypto project reveal their real names, credentials and pictures. Check the official website of the project, if you cannot any of these information about the team members and CEO, kindly stay clear, the project has a skeleton in its cupboard.

Some projects upload fake pictures, name and credentials for the team members. So you need to confirm that the uploaded details are authentic. One of the easiest ways to confirm the authenticity of the team member pictures uploaded in the project’s official website is to “reverse image search” for those photos on Google. Right click on the picture on the official website of the project, and then click on “search this image on Google”. If you discover that the duplicate of any of those photos are attributed to someone else, run from such project, it is fake.

Also, you can search the names of the project team members on Google and check if the details of those members provided in the project website correspond to your search result. If there is any mismatch, avoid the project. The social media profiles (especially LinkedIn, GitHub and Twitter) of the project team members can also be helpful and even make the research easier.

Some of the key information to Look Out for include:

- Area of expertise of the team members

- Level of experience in their roles for the project. Do they have much experience in the cryptosphere or any blockchain-related field?

- How many of their previous projects were successful?

4. Who are the Top Investors of the Crypto Project?

How renowned are the top investors of the project? These will help you know if the project team and CEO are trustworthy or not. Reputable companies or individuals will only invest in projects with trusted and reputable CEO and team members. If many reputable companies and individuals have invested greatly in the project, then there is a higher probability that the project will be successful, and that the project team will not abandon the project and disappear with the raised funds for the development of the project.

Another thing to check is the fund-raising policies for the project. What happens when the estimated fund needed for the project development is not raised within the stipulated fund-raising period? Will the investors be refunded? These are some of the things to check when looking for a crypto project that will be successful in the future.

5. How Reasonable is the Project Whitepaper?

Whitepaper is document where project team explains everything about the project; its technical information and a roadmap of how the project plans to grow and become popular, what differentiates the project from its competitors, etc. A summarized version of a whitepaper is called a Litepaper.

A whitepaper is one of the first things an experienced investor checks, to know if the project is worth investing in. Although a whitepaper serves as a marketing tool which the project team provide in order to convince investors to invest and support the project, it is expected that the project team fulfil what they promised to do in their whitepaper. But also note that some scam projects publish whitepapers that are too good to be real. They make a lot of promises, which they will never fulfil, and will never state some of the challenges the projects might encounter.

Once you see such whitepapers that are not reasonable, don’t ever invest in such projects, especially for long term. The sole aim of such project teams is to deceive investors, abandon the project and then run with their funds in the future.

6. Check the Reviews of the Project in some Top Crypto Discussion Platforms

When searching for cryptocurrency gems, make sure you find the thread (especially the ICO announcement thread) for the project, read both the positive and negative reviews about the project. Pay close attention to the negative reviews and do your own research and analysis. Also check the questions that were asked by other investors about the project and the answers the project CEO or team member gave.

Some of the top cryptocurrency and blockchain discussion platforms are Bitcoin Talk forum, Reddit and even Twitter.

7. Is the Source Code for the Crypto Project’s Token Visible or Hidden from the Public?

Good crypto projects make the codebase for their tokens and coins visible to the public in places like GitHub, so that anyone could view the code. While shady crypto projects keep the codebase of their cryptocurrencies away from the public by hiding them in their private blockchain.

8. Perform thorough FA & TA for the Cryptocurrencies

FA means Fundamental Analysis while TA means Technical Analysis. Both make up market analysis. For FA, you use a number of internal and external factors to determine whether an asset is overvalued or undervalued. FA will help you know if a project is worth investing in or not. Most of the factors we have been considering above are FA factors. Once you have discovered an good asset with future growth potential (in this case, a crypto coin or token) with the help of FA, you now go further to perform TA for the coin, in order to know the best price range to buy the coin and the best price range to sell coin or take profit, in order to maximize profit.

Note that not all FA metrics are strong enough to help you discover a genuine project. An example of a weak FA metrics is the number of social media followers. It is not a strong FA because it can be easily manipulated. A project can create a fake a fake social media account like Twitter, Telegram and Reddit, or even buy followers or engagement.

The key FA metrics are classified into 3 categories:

- On-chain metrics

- Project metrics

- Financial metrics

The On-chain metrics are observed by looking at the data provided by the blockchain. Sites like Coinmarketcap, Coinmetrics, and Coingecko provide information for on-chain analysis of crypto projects. Some of the on-chain metrics indicators are: transaction count, transaction value, fees paid, active addresses, hash rate and the amount staked.

For the project metrics, you study and evaluate the quality of some of the essential aspects of the project to know if the project has a promising future or not. Some of the project metrics key indicators are: the project whitepaper, project team, main competitors of the project, tokenomics and initial distribution.

For the financial metrics, you carefully analyse the direct and indirect indicators that help to determine the financial state of the project at any given point in time. Some of these key indicators are: market capitalization, supply mechanism, liquidity and trading volume, etc.

For TA, you need to observe and study the patterns of coin’s price movement, trading signal and some other analytical tools to evaluate the strength and weakness of the coin or asset. Some of the popular TA terms and indicators include: market trend, resistance and support, candlestick charts, Moving Average Convergence Divergence (MACD), Bollinger Bands (BB or BOLL), Relative Strength Index (RSI), Moving Average (MA), Stochastic RSI (StochRSI), etc.

For more details, check out this article: Simplified Guide to Cryptocurrency Market Analysis & Tools.

9. Price, Trading Volume and Market Capitalization (M.Cap.)

Hidden crypto gems don’t usually have much trading volume because only few people value the project at the moment and they are not yet trading in popular exchanges. Most times, the price per token/coin is usually small. But as more investors and traders discover the potential of such gem coin, the price and trading volume will skyrocket, rewarding early investors more.

The Market Capitalization (M.Cap.) of a coin/token is the fiat amount needed to buy up the current circulating supply of the token.

M.Cap. and price of a coin are related by this expression:

M.Cap. = Price per Coin * Current Circulating Supply of the Coin

Note that the circulating supply of a coin changes with time and is different from the total/maximum supply of the coin.

Hidden crypto gem coins usually have small M.Cap., which increases as either the price of the coin or its current circulating supply increases.

Check:

- Complete Blockchain Career Guide & Job Opportunities

- Cryptocurrency Staking (PoS) Guide for Beginners

Some FAQs when Searching for Crypto Projects with Future Powerful Potentials

What is an ICO?

ICO means Initial Coin Offering. It is one of the popular fundraising methods that new start-up companies, especially blockchain companies. Here, a new company which needs money for project development or expansion creates a digital currency or token which will power the project. The company also creates a whitepaper, which will help investors know what the project is all about, the terms and conditions of the ICO, and whether it is worth investing into. Interested investors buy these new tokens with either fiat or existing cryptocurrencies. After a successful ICO, the new company then uses the funds raised through ICO to develop the specified project and grow the company.

If the project succeeds and the price of the token skyrockets, these early investors make massive profit by selling the token.

ICOs are similar to IPOs (Initial Public Offerings) that was popular during the internet bubble. But unlike the IPOs which deal only with investors, anybody who wish to support any new project offering ICO can participate.

Is it worth Investing in Crypto Project ICOs?

Participating in the ICOs of projects that have powerful growth potentials can earn you massive returns in few years to come. For example, if you had invested up to $1000 in Ethereum’s ICO in 2013, that fund would have yielded more than a million dollar return now.

So the secret in making huge gains from ICOs lies in finding these gem projects and then participating in their ICOs.

Also note that ICOs are not fully regulated by financial authorities like SEC, and not all companies become successful after the crowdsales via ICO. Just like the internet era, where only few companies like eBay and Amazon were successful after a successful IPO.

Also make sure you fully understand all the terms of the ICO stated in the project’s whitepaper. Avoid ICOs where the funds are note stored in an escrow wallet (that is a wallet that requires multiple keys before the funds stored in it could be accessed).

What is the Best Time to Research for Crypto Projects with Powerful Potentials?

The best time to research about crypto projects that have hidden powerful potentials is during bear season, when the prices of most tokens have fallen. Also, during bear season most scam project teams abandon their projects, which leads to the death of these projects. But during bull season, the price of almost all tokens pump hard, which makes it difficult to spot these gem coins/projects.

Good crypto projects will survive multiple bear seasons, unlike some of the scam projects, because they have very strong fundamentals and use case(s).

When is the Best Time to Invest in Crypto Projects?

Once you have done a deep research and have found good crypto projects, you can start investing in them. In order to earn more ROI (Return on Investment), invest towards the end of the bear season. But since no one can predict with certainty when bear season starts or ends, you can apply DCA (Dollar Cost Averaging) during bear seasons, an investment strategy where you buy in batches at different price ranges, in order to average out the cost per token.

When is the Best Time to Sell Off their Tokens or Take Profit?

The best time to take profit for your crypto investments is during bull season, when the prices of most coins are pumping hard. Since you cannot predict the ATH of most coins during bull seasons, the best option is to take profit in batches as the price of the coins keeps pumping. Don’t sell all your portfolio at a particular price. This way, you will never be fully caught under water, even if the bear season sets it so suddenly.

Most new crypto traders and investors are carried away by the euphoria of bull season, thinking that the prices of cryptocurrencies will keep going up forever. Then when a sudden dip occurs and the prices of the tokens drop, they give back all their profits and even a part of their capitals to the market.

In general, have a specific goal for each of your investments. By goal I mean having a set price range to take profit. For example, you can sell, say 70% of your Ethereum after a specific percentage profit (say 100% or 150% from your entry price). Then you can also sell, say 60% of your remaining ETH portfolio if the coin reaches, say 300% from your entry price.

Here is a free cryptocurrency profit/loss calculator to help you out.

What is the difference between a Shitcoin and a Gem Coin?

A shitcoin is the cryptocurrency of a scam project, while a gem coin is the cryptocurrency of a project that has a strong growth potential. Although it is difficult to differentiate between shitcoins and gem coins, but a thorough Fundamental Analysis (FA) on any project) can help you distinguish them. A shitcoin has no real use case, and even if it has a use case, it cannot solve any challenge in future time.

NOTE: Do not fall prey to scam projects who make fake promises in their whitepapers and roadmaps. They only do so to deceive investors and then run away with their funds in future. If a project team does not keep up to what they promised in their whitepaper without any good reason, run from such projects.

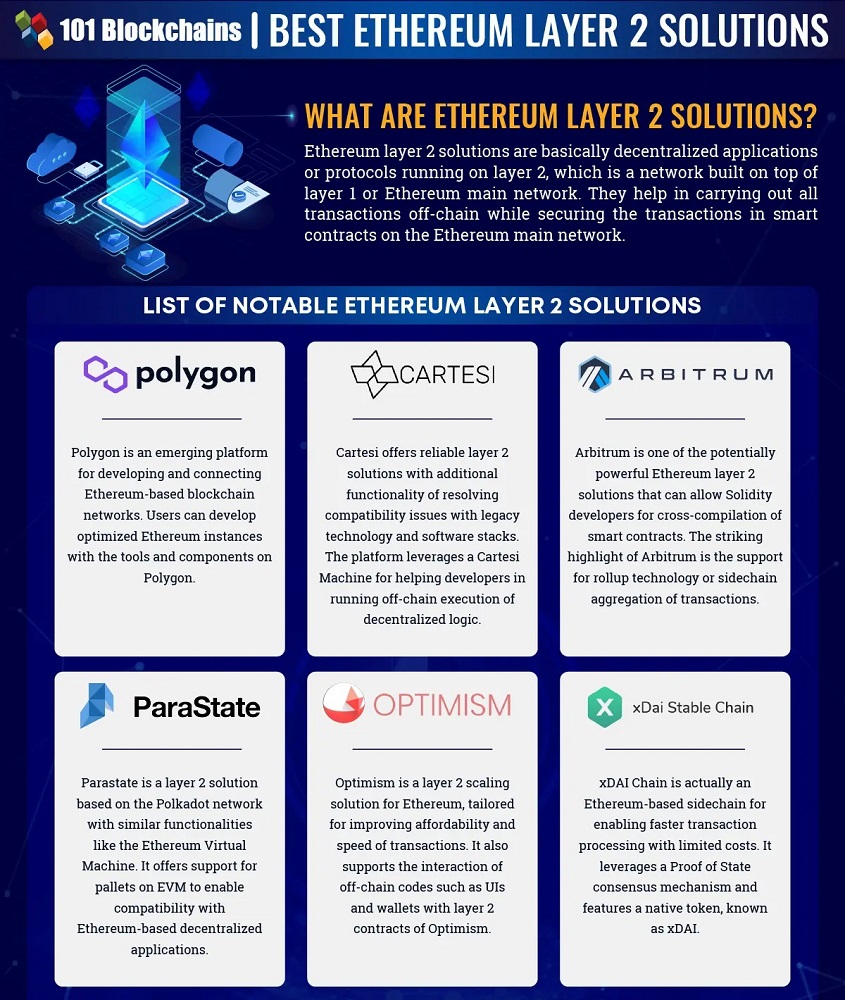

What are the different of Blockchain Layer Solutions and their Differences?

The 2 main blockchain technology layer solutions are Layer 1 and Layer 2. Layer 1 serves as the underlying (base), security layer which handles data transaction in an immutable and cryptographically-secure manner. Layer 2 technology, popularly known as “Off-chain solution” is the overlying network or protocol on the base blockchain (layer 1). The main reason for layer 2 protocols is to solve the scalability and speed issues of their layer 1 blockchains. Layer 2 protocols ease off the load on their base layer, thereby increasing the processing speed and scalability of the entire network.

Another distinguishing feature between layer 1 and layer 2 blockchain technologies is that layer 1 relies on the immutability nature of its blockchain for security, while layer 2 relies on the security of its base layer.

A blockchain network can have multiple layer 2 protocols addressing or taking care of an issue on the underlying layer. A good example is the Ethereum network, Ethereum. Some of the notable layer 2 solutions on Ethereum network include: Polygon, Cartesi, Arbitrum, Parastate, Optimism, xDAI Chain, etc. All these networks or protocols stay in the Ethereum network in form of smart contracts.

Some Promising Crypto Projects with Massive Potentials

Here are some strong crypto projects that might bring some good returns in future (long term).

Near Protocol (NEAR)

NEAR Protocol is a decentralized application platform with a simple, secure and scalable technology, and also has the potential to change how systems are designed, how applications are built and how the web itself works. NEAR protocol has already implemented what Ethereum plans to use to permanently solve the issue of scalability on the network by the year 2025, which is sharding.

You can read more about NEAR Protocol in these research resources:

Flux Protocol (FLX)

Flux Protocol is a cross-chain oracle providing smart contracts with economically secure data. It is the trustless data layer for web3 tech and also enables users to access data on-chain from a wide range of services. The project is to NEAR ecosystem (and even beyond) what ChainLink (LINK) is to other ecosystems. Once NEAR achieves mass adoption, Flux Protocol will become a giant cross-chain oracle.

You can read more about Flux Protocol (FLX) in these research resources:

Octopus Network (OCT)

Octopus Network is a multichain interoperable network for launching and running Web 3.0 substrate-based application-specific blockchains, popularly known as appchains. The network is committed to unleashing a new wave of innovation for Web 3.0, which is the future of the internet.

You can read more about Octopus Network (OCT) in these research resources:

Oasis Network (ROSE)

Oasis Network is a privacy-enabled blockchain platform for open finance and a responsible data economy. The network seeks to fix that by creating a new paradigm — a blockchain where privacy is key. Combined with its high throughput and secure architecture, the Oasis Network is able to power private, scalable DeFi, revolutionizing Open Finance and expanding it beyond traders and early adopters to a mass market.

You can read more about Oasis Network (ROSE) in these research resources:

Algorand (ALGO)

Algorand is a permissionless, Pure Proof-of-Stake (PPoS) blockchain that ensures full participation, protection and speed within a truly decentralized network. The network also aims to remove technical barriers that have undermined mainstream blockchain adoption, which are: decentralization, scale, and security. Most users call this blockchain project “Blockchain 3.0”, because it solves Bitcoin’s well-known scalability problems while maintaining security and decentralization.

You can read more about Algorand (ALGO) in these research resources:

Other projects in my watch list include:

- Fantom (FTM)

- Harmony (ONE)

- Immutable X (IMX)

- KuCoin Shares (KCS)

- UTrust (UTK)

- Effinity (EFI)

- XYO Network (XYO)

- Scallop (SCLP)

Disclaimer: This is not a financial advice, they are just my personal view. You can do your own research on these projects using the Fundamental Analysis (FA) and Technical Analysis (TA) tips I explained in this article. You can also go through their white paper and know what future plans the projects have.

See:

Conclusion

You have learnt some of the tips to help you discover crypto gem projects, how ICOs work, how to differentiate between gem coins and shitcoins, crypto projects with powerful potentials, etc. Apply these tips as they will help you make good investment decisions and make more profits from your crypto portfolio.