In this article, you will learn some of the basic things you need to know before you start trading or investing in any cryptocurrency or even day trading. You will learn how to convert USD to BTC or ETH and all about cryptocurrency market capitalization (market cap. or M.cap.). Lastly, you will learn how to track Bitcoin and Ethereum transactions using blockchain.com explorer and etherscan explorer respectively.

Day Trading Guide

Day trading is a special type of short term trading done by active traders who execute intraday strategies to profit off of price changes for a given asset, like cryptocurrencies. Day trading can be a very lucrative venture as long as you do it properly, but it can also be very challenging for novices, especially for those who don’t have a well-planned strategy. The main feature of day trading is that the traders buy the asset and sell it off the same day for profit, or some times for loss.

To be successful in day trading, you must be well grounded in technical analysis and also possess a high degree of self-discipline and objectivity.

Below are some of the strategies used by day traders:

- Scalping: With this strategy, they attempt to make numerous small profits on small prices changes throughout the day.

- Range trading: With this strategy, they discover favorable support and resistance levels to determine buy and sell decisions.

- News-based trading: News generally affect the prices of assets. So with this strategy, day traders typically seize trading opportunities from the heightened volatility around news events.

- High-frequency trading (HFT): This strategy involves the use sophisticated algorithms to exploit small or short-term market inefficiencies.

Day Trading Advice

- Do not day-trade large-cap coins: The prices coins with of large market capitalization like BTC, ETH, etc. are the less volatile. They need huge capital investment to move the price up. They yield best in long term investment.

- Day-trade low-cap coins with high growth potentials: Coins with low market capitalization are the most volatile. Their prices can easily go very high and also come down very low within a short period of time. Note that not all low-cap coins will yield high ROI in day trading. Look for low-cap coins with very high growth potential, especially on short term basis.

- Trade with the amount you can afford to lose: Always remember that day-trading is riskier than long term trading. So in order to make sure you don’t get wrecked financially, trade with the amount you can afford to lose because crypto market is generally volatile and can go south any moment. If you are not willing to take the risk involved in day trading, then consider investing for long term in cryptocurrencies.

- Always Start with Small Capital: Focus on a few coins rather than going into the market head-first and wearing yourself thin. Going all out will only complicate your trading strategy and can mean big losses.

- Be ready to devote your Time to the Trade: Day trading is a business that requires a lot of time. If you want to perfect your strategies, after you’ve practiced, you’ll have to devote a lot of time to it. This isn’t something you can do part-time or whenever you get the urge. You have to be fully invested in it because the prices of crypto coins are generally volatile. If you don’t have much time to devote to day-trading, then focus on long term trading.

- Know and apply the necessary Strategies: There are several different strategies day traders use including swing trading, arbitrage, and trading news. These strategies are refined until they produce consistent profits and effectively limit losses. The risk and reward levels of these strategies vary. Swing trading strategy is the riskiest and also has the highest reward level.

In summary, the main differences between day trading and long term trading is that day traders take more risk and use capitals they can afford to lose. But this capital must be tangible if you must make a fortune from day trading. Long term traders are investors who are willing to hold the asset for a very long time, no matter the level of fluctuation in the market. They only sell when they have made huge profit, most times, not less than 100%. While day traders are willing to sell their bags off the same for profit or loss, say plus or minus 5% or 10%.

For more tips on Day trading, check out this beginners guide on day trading at Binance Academy.

See:

Bitcoin vs. Stocks

Many investors ask, “Between Bitcoin and Stocks, which one is more profitable?”

The answer cannot be complete without a proper comparison between the two. Check the comparison chart.

These are the key things you should note:

- Bitcoin is more volatile than stocks, this means that the price of Bitcoin can increase or fall to the extreme. In fact, the value of Bitcoin can make or break a millionaire.

- Because of the uncertainty in the price of Bitcoin, it is advisable to limit the amount of Bitcoin in an investment portfolio.

The summary is don’t put all your eggs in one basket.

Coin vs. Token

Most users use the word “Coin” and “Token” interchangeably. Though they have similarities, but in the real sense, there is a difference. The similarity is that both are cryptocurrencies.

A digital Coin is a cryptocurrency that is native to its own blockchain. For the cryptocurrency of a blockchain protocol or project to be called a coin, the protocol must have its own mainnet; which means that the has now been fully developed and deployed, its transactions are broadcasted, verified and recorded in its own blockchain. Example of crypto coins are BTC, ETH, NEO, ADA, BNB, LTC, XRP, ADA, XLM, etc. Each of these coins exist on their own independent blockchain. Some altcoins are considered as coins, but they are not Bitcoin.

Tokens are cryptocurrencies that are created on existing blockchains. The most common blockchain token platform is Ethereum. Tokens that are built on the Ethereum platform are known as ERC-20 tokens. Examples of ERC-20 tokens are MKR, OMG, REP, BAT, LINK, etc. Tokens that are built on the NEO platform are known as NEP-5 tokens. Examples of NEP-5 tokens are ONT, NEX, ZPT, TKY, DBC, etc.

NOTE: A token can migrate from being a token to being a coin once its protocol launches its own mainnet. Example is the Binance Coin (BNB) the native currency of the Binance exchange, launched in 2017, is no longer a token, since the protocol now has its own mainnet – Binance Smart Chain (BSC), which was launched in September 2020. This means that the native token of the Binance exchange (BNB) is now a coin. Tokens that are launched in the Binance Smart Chain are referred to as BEP-20 tokens. Also note that a token can be launched in more than one blockchains. Such tokens are called multi-chain tokens.

Check:

- Recommended Cryptocurrency Investment Security Tips

- Simplified Guide to Cryptocurrency Market Analysis & Tools

The Basic Unit of Bitcoin

One of the special attributes of cryptocurrencies is their divisibility. Bitcoin is not excluded. It can be split into smaller units to ease and facilitate smaller transactions.

The basic unit of a bitcoin is Satoshi, (called Sat. for simplicity); gotten from Satoshi Nakamoto – the name of the man who created the protocol used in blockchains and the bitcoin cryptocurrency.

- 100,000,000 Satoshi = 1 BTC (Bitcoin)

- Therefore 1 Satoshi = 1/100,000,000 BTC = 0.00000001 BTC

- Thus a Satoshi is equivalent to 100 millionth of a bitcoin.

NOTE:

For simplicity, bitcoin fractions are measured in Satoshi. For example:

- 00000001 BTC = 1 Satoshi

- 00002000 BTC = 2,000 Satoshi

- 99999999 BTC = 99,999,999 Satoshi, etc.

How to Convert any USD Amount to BTC or Satoshi Manually

Once you have known the basic unit of bitcoin and its value, you can convert any amount in USD to BTC or Satoshi.

This becomes very useful when you want to sell your BTC for USD. You need to know the amount of satoshi that is equivalent to any amount in USD.

For this, you need to know the current equivalent of 1 BTC in USD.

The formula for converting any USD amount to BTC is:

= (USD amount you wish to convert to BTC)/(Current value of 1 BTC in USD)

For example, assuming you have 2.5 BTC in your wallet and a client wants to buy 5,000 USD worth of BTC. Assuming the current value of 1 BTC is 40,000 USD.

Then the current equivalence of 5,000 USD in BTC

= 5,000/40,000 = 0.125 BTC

NOTE: For BTC conversion, always approximate to 8 decimal places.

It can also be said that 5,000 USD is equal to 12500000 Satoshi (as at when this article was written).

0.125 BTC = 12,500,000 satoshi.

The Basic Unit of Ethereum

The basic unit of Ether (ETH) is Wei.

1 Wei = 0.000000000000000001 ETH = 1e-18 ETH

NOTE: The most commonly used unit of Ether (ETH) is Gwei because Ethereum “gas” fees are measured in Gwei.

Gwei is also called nanoether, to denote that 1 Gwei is equal to ninth power of the fractional Ether (ETH).

1 Gwei = 0.000000001 ETH = 1e-9 ETH

So 1 Ether (ETH) = 1,000,000,000 Gwei = 1e+9 Gwei

The expression relating Gwei to Wei is

1 Gwei = 1,000,000,000 Wei = 1e+9 Wei

How to Convert any USD Amount to ETH or Gwei Manually

Just as we did for BTC, you can convert any USD amount to ETH or Gwei.

This becomes very useful when you want to sell your ETH for USD. You need to know the amount of ETH that is equivalent to any amount in USD.

For this, you need to know the current equivalent of 1 ETH in USD.

The formula for converting any USD amount to ETH is:

= (USD amount you wish to convert to ETH)/(Current value of 1 ETH in USD)

For example, assuming you have 2 ETH in your wallet and a client wants to buy 1,000 USD worth of ETH. Assuming the current value of 1 ETH is 2,800 USD.

Then the current equivalence of 1,000 USD in ETH

= 1,000/2,800 = 0.357142857142857 ETH

NOTE: For Ether conversion, always approximate to 9 decimal places.

It can also be said that 1,000 USD is equal to 3,571,42,857 Gwei (as at when this article was written).

0.357142857 ETH = 3,571,42,857 Gwei.

You can use our free cryptocurrency and foreign exchange converter app to easily convert between cryptocurrencies, or between cryptocurrencies and fiat currencies.

What is the Best Time to Buy Bitcoin?

As a cryptocurrency trader or investor, your main aim is to make profit. You can only be in profit when your selling price is higher than the cost price.

So when buying Bitcoin, your target should be to buy when the price is low. But most times, it is very difficult to predict the price of Bitcoin at any point in time. The best way to ensure that you bought at a fairly low price is to do dollar cost averaging, which means buying a coin at different price ranges to reduce your average unit cost price.

The secret to making more profits in Bitcoin trading is to buy when the majority of traders are afraid to buy and sell when the majority of traders are willing to buy.

Always remember that the prices of cryptocurrencies are highly volatile, so make your own research before you invest. Always utilize Technical Analysis.

What is the Best Time to Sell Bitcoin?

Once you have gotten enough Bitcoin bag, your next target is to maximize profit. Most times, selling all your bags at a particular price is not the best decision. You might sell at a particular price and Bitcoin price goes higher.

The best solution is to target different percentage profits. For example, depending on the nature of market for that period, you might target, say 30%, 50%, 100% or more. Once you reach any of these percentage profits, you dump a certain percentage of your total Bitcoin bag.

You also need to be smart while doing this. Study the market trends. Adjust your decisions according to market trends. For example, you might want to sell half of your bag when you reach 30% profit and the other half when you reach 50% profit. Assuming your first target has been met and you sold half of your bag. Then Bitcoin price continued to increase and you reached 45% in profit. Suddenly market trend changed and price began to drop, say back to 35% profit. What a smart short term trader will do is to sell off all his bag if he predicts that the price will fall further. Then buy back when the price has fallen below 30% profit.

The above strategy becomes very useful in a bearish market where the prices of cryptocurrencies fluctuate. In a bullish market, you may target a particular percentage profit. Once you sell off your bag, you wait until the price falls again to buy back at a lower price.

Note that there are some trading decisions that will favour only short term traders. It takes a lot or experiments to understand the Bitcoin market. Analyze the market before you take any step.

Check:

- 30 Helpful Strategies for Making Money in Cryptocurrency Trading

- All About Bitcoin: History, Inventor, Price, BTC vs. Other Currencies

Classifications of Cryptocurrencies Based on their Market Capitalization

One of the most useful metrics for estimating the real worth of a cryptocurrency is Market Capitalization. It is simply the amount needed to buy all the available supply of a crypto coin at any point in time. Market capitalization of a cryptocurrency is the product of the total circulating supply of the coin and the price of each unit of the coin. In this section, you will learn the various classifications of cryptocurrencies based on their market cap. This will help you take a smart cryptocurrency investment decision, especially in the long run.

Generally, all cryptocurrencies can be classified based on their market caps into the following groups:

- Large-Cap Cryptocurrencies

- Mid-Cap Cryptocurrencies

- Low or Small-Cap Cryptocurrencies

Coinmarketcap.com lists cryptocurrencies in ascending order of their market cap.

1. Large-Cap Cryptocurrencies

These are cryptocurrencies with more than 10 billion USD market cap. Companies with more than 10 billion USD market cap are classified large-cap companies. The price of cryptocurrencies that fall under this category does not fluctuate much, hence they have the least volatility.

According to Coinmarketcap data, Bitcoin (BTC) has the highest market cap. In fact it is the safest coin to invest in. But this does not mean it will yield the best Return on Investment (ROI). Other coins under this category are: Ethereum (ETH), Tether (USDT), Ripple (XRP), Binance Coin (BNB), etc.

2. Mid-Cap Cryptocurrencies

These are coins with market caps between 1 billion USD and 10 billion USD. Their market cap are lesser than those of large-caps. This also means they have more volatility than those of large caps. Mid-cap coins usually have more ROI than large-cap coins during bull market season. Also, they experience more severe price dump than large-cap coins during bear market seasons.

3. Low or Small-Cap Cryptocurrencies

These are coins with market caps below 1 billion USD. They have the highest volatility. This means they can make you very rich during bull market seasons and can also wreck you during bear market seasons.

Which Category of Cryptocurrencies are the Best to Invest In?

There is no direct answer to this question. Just know that each category or class of coins has its advantages and disadvantages. For example, large-cap coins have the most stable prices, but most times, they have the lowest ROI, especially on short term investment.

Generally, the larger the market cap of a coin, the more capital needed to change move the price, either up or down.

For example, assuming you invested on a coin with a 10 billion USD market cap, the coin needs an extra investment of 10 billion USD to yield 100% profit. So the price of the coin cannot be easily changed. Now compare it with an investment on a low-cap coin, say 50,000 USD. A whale can easily move the price by 100% by investing 50,000 USD in the coin. But once the whale takes back his capital, the price of the coin will crash. This brings about the high price volatility of low-cap coins.

So what most smart investors do is this: during bull market seasons, they investment more in low-cap coins with high growth potentials and enjoy high ROI. Then during bear market seasons, they save their capitals by investing more in large-cap coins, especially Bitcoin and Ethereum.

NOTE:

This is not a financial advice. Make your own research before you invest in any cryptocurrency because crypto coins investment are high-risks high-rewards investments.

But do not for any reason invest all your capital in one cryptocurrency, no matter how promising it may look.

How to Track Bitcoin Transactions and Know its Status

There are times you will might need to track your Bitcoin transactions. For example, assuming you bought Bitcoin from a trusted third-party, and you were informed that the Bitcoin has been sent to your wallet address. Remember that the coin will reflect in your wallet after the transaction has been confirmed by at least one network. This might take up to 30 minutes or more. To know the current status of the transaction, you need to track it. You can you blockchain.com explorer.

To Track any Bitcoin Transaction:

Copy the recipient’s Bitcoin wallet address or the transaction hash/ID to your clipboard. A transaction hash/ID is a unique string of characters that is given to every transaction that is verified and added to the blockchain. If you are buying Bitcoin from a third-party, the transaction hash will be sent to you.

Go to https://www.blockchain.com/explorer. Paste your Bitcoin wallet address or the transaction hash in the search bar and click press the Enter key.

If you pasted a Bitcoin wallet address, you will be notified that there are 2 blockchains with result(s) to your search. Select BTC Address.

Under the Transactions section, you will see the status of the last transaction of the wallet address. You can click the hash to see more details about the transaction.

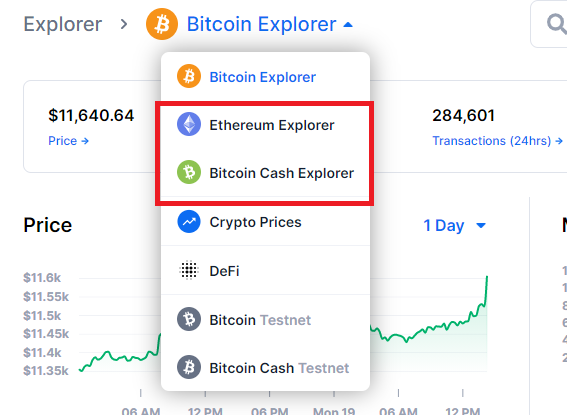

NOTE: You can also use blockchain.com explorer to track Ethereum (ETH) and BitcoinCash (BCH) transactions. Just click the drop down arrow near Bitcoin explorer and then select Ethereum Explorer or BitcoinCash explorer.

How to Track Ethereum Transaction and Know its Status

Ethereum also has a special explorer you can use to track any ethereum transaction. Etherscan.io allows you to explore and search the Ethereum blockchain for transactions, addresses, tokens, prices and other activities taking place on Ethereum network.

To Track any Ethereum Transaction:

Copy the recipient’s Ethereum wallet address or the transaction hash/ID to your clipboard.

Go to https://etherscan.io/. Paste your Ethereum wallet address or the transaction hash in the search bar and click on Search.

You will see an overview of the Ethereum wallet that has the address. In the Transaction section, you will see the details of each transaction, with the latest transaction being at the top. You can click the Transaction hash (Txn Hash) to see more about the transaction.

YouTube Tutorial Video: The Ultimate Cryptocurrency Trading Course for Beginners

See:

-

15 Best Secured Cryptocurrency Exchange Platforms for Trading

-

Understanding the Blockchain Technology, Bitcoin & Cryptocurrencies

Conclusion

You have now learnt the necessary crypto trading basics that will help you become successful as a crypto trader or investor. Feel free to apply the tips explained in this article in your trading journey. You can drop your contribution or questions about this topic in the comment section below. Enjoy!